Great post from Andrew Scott on venture capital, funding and growing your start up

The Myth Of Silicon Valley

Recently the on-going discussion of London versus the Valley has got a higher profile again thanks to articles like this and the fact European VC’s still seem unable to evolve let alone revolve: Even Fred Destin say’s European VC’s need revolution not evolution. Here here to that.

While the average London start-up’s dilemna* is should I go to Silicon Valley or stay in Silicon Roundabout? (which I touched upon last week) and takes the mind share of the European tech-elite, I don’t think the Americans give two hoots. Why would they? Silicon Valley is where it’s at, right?

What did catch their attention was Hermione Way’s post “The Problem With Silicon Valley Is Itself“ on The Next Web, which prompted a response from Robert Scoble on Google+, both worth reading by the way.

Has Silicon Valley Lost It’s Way?

Loosely, Hermione complains that The Valley no longer truly innovates and it is full of fluff. Robert says it is still the only place really changing the world and no-one else does in the same way or to the same extent.

Naturally as I’m writing a retort, I must have a different view: I think they’re both wrong; but there is an element of truth in both claims.

With Silicon Valley, it’s the iceberg problem. You only see the tip of what’s going on underneath. Even I have grown tired at times of the sometime obsessions (and many say poor journalism) of platforms like Techcrunch; but you have to be realistic about what they represent. They are not trying to be the BBC or a broadsheet. They are for mass market consumption by the geeks, the early adopters, the DiggNation kids and Appleheads. At this they excel.

As a tabloid Techcrunch will write what sells impressions – they are not representative of the depth of Silicon Valley.

The problem is surely that inevitably, like the general news on TV and in most tabloids, it skews to easily consumed, often banal, content. The lowest common denominator.

The masses are selfish; they don’t care about new window material technology for the Empire State Building, they care about Big Mac $1 Burgers, Foursquare checkins, saving 50% via Groupon on their next t-bone steak. They care about themselves (see: Facebook, Google+, Flickr ..they are all about your ego, about your life).

This is why Techcrunch.com doesn’t shout about the other low level technologies (or indeed publish much about things outside of the USA) and instead you get 3 posts a week for 9 months straight about a company like Foursquare. Well, good for Foursquare. Gaming location, the system and MG all in one go!

Of course, I’m simplifying the argument, but one has to, to make a salient point.

These publishers publish that stuff because people consume it. They don’t care about a new silicon chip design, even if it does save lives or save money. It’s too abstract for most people.

The Myth Of Silicon Valley

So let’s look back for a moment. Why is Silicon Valley (and it’s venture capital ecosystem) Silicon Valley? Actually, it has a far longer history of entrepreneurship than most other centres of technology.

Silicon Valley started growing toward it’s present day nearly 100 years ago. During the war, the government funded innovation for large military and cold-war driven contracts with radio related technology, radar and later, other electronic warfare.

This graph is NOT true. Silicon Valley grew gradually since the war, it’s taken decades. Click for more information and Steve Blanks excellent -and accurate- history.

This graph is NOT true. Silicon Valley grew gradually since the war, it’s taken decades. Click for more information and Steve Blanks excellent -and accurate- history.

Frederick Terman from Stanford played a pivotal role in the 40′s and 50′s pushing students out of education encouraging them (instead of doing PhD’s or masters) to start-up innovative technology firms to serve the country and defend against the Nazis and then the perceived Communist threat.

The 60′s brought transistors, the 70′s microchips, then Microsoft, Apple and the other leviathons we all know today. At the end of the 70′s deregulation in the investment markets enabled Venture Capital to begin in earnest.

London, Berlin, Amsterdam nor Tel Aviv has had any of this history. A few cycles of Silicon Valley computer and internet boom later and there are:

- 100′s and 100′s of VC’s thus a huge pot of money

- A tech ecosystem which is bigger than anywhere

- There is a bubble cycle of hype driving investment and belief in the next big thing

- and a lack of understanding of the outside world (actually sometimes useful when building a company which every normal person says nobody will ever use: see Twitter).

Add to this a huge early adopter crowd which can test-bake the next crazy Twitteresque idea to see if it’s real – all 2 years in advance of the rest of the western world being ready to use it – and you have a compelling place to create some seriously game changing products and services.

These advantages are why we in Europe are behind with consumer internet, why we don’t have a Google, a Cisco and now with mobile phone software it is the valley where innovation is getting funded in way which will give the start-ups longevity to get their new services right. It’s why Facebook and Google grew in the Valley.

I feel innovation in Silicon Valley – both whether hardcore tech or social media – is alive and well. Hermione should have cause to be worried about her native land though, for the same reasons she moved to Silicon Valley rather than continue in Silicon Roundabout or move to Silicon Alle or Silicon Valley! (do keep up ![]()

European Unadventure Capital

The history and experience in the Valley, also contribute to why European Venture Capital is behind and why our ecosystem is behind. We simply don’t have it.

Had visionaries in Cambridge (and government people in charge of technical innovation) pushed harder during the first dot com boom to make Silicon Fen more than a running joke, then Cambridge England might have had a 10 years start on Silicon Roundabout.

Cambridge was and is about the right size to become a town all about tech. It remains an important centre for science and biotech, but it is no centre for internet start-ups and with the growth of Old Sreet never will be.

I started a localized web portal in Cambridge (wanting to scale to 140 towns and cities) in 1998, but couldn’t get funding. Arguably a lack of vision from investors -rightly or wrongly- prevented access to capital. I pivoted to B2B and a web development company which I later exited.

It’s a hugely wasted opportunity; possibly contributed to by the all suffocating Cambridge University which essentially controls the city and most certainly because of a lack of available investment capital for start-ups.

There’s something going on though, as New York is hardly a small city yet seems to be catching up with it’s Boston neighbour, touting Silicon Alley.

Cities like London and New York are almost too diverse, with lots of other history and other industries, meaning “Tech” will never be elevated to the focus which San Francisco and Silicon Valley enjoys.

Small means focused.

Where else would you be able to start Square and have tech-savvy iPad owning shop keepers and cafe owners clammer for the service with open arms? Once it’s proven, bug fixed and entrenched in Palo Alto and San Francisco, where everyone carries an iPhone, they’ll raise another 1/2 billions dollars and take over the world.

So Silicon Valley Is The Centre Of World Innovation?

In essence I agree with Robert Scoble that the depth of innovation is SV is astounding; however he is wrong to say world changing technologies don’t come from elsewhere.

That ARM processor in nearly every mobile phone you’ve touched in the last 2 years? That’s from Cambridge, England (my home town in fact).

The computer? invented in England.

The jet engine? England (and if our government had funded it to the extent the US government funded innovation in Silicon Valley, WW2 would have been a lot shorter!)

OK so you see where this is going…

For me problem with the UK and Europe compared to America and Silicon Valley, is we’re not good at scaling.

Sure, the financial industry seems to do it just fine – raping and pilleging it’s way literally to the top of the global finance world; but taking good technologies and funding them, patiently nurturing them, growing them, having faith in them and their young founders, to become truly global players seems to be something in the UK and Europe we’re not very good at.

THAT is the big question.

The question is not why can’t we innovate, for we don’t lack of innovation. The question is why are we unable to scale our innovations rapidly to become the global market leader?

Back in Europe, where the history comes from…

One problem in London and Europe for technology innovation to scale (aside from these), is certainly finance.

This is grossly ironic, given London’s pre-eminence London is the world’s global financial capital, with New York in second place and Hong Kong in third.

The discussion of the problems with European VC’s, the lack of Googlesque companies and whether a start-up should start, or move, to The Valley, is a persistent topic in the London tech scene. The UK versus US funding debate is always threatening to popup on tech conference panels; to some extent for good reason but it also becomes boring and negative, though I entirely understand why the conversation needs to be had.

The ecosystem in London is less developed and the VC’s (with a few exceptions) are guilty of much of what Nic Halstead (and many more behind closed doors) will tell you: tech venture capital in London is run by financiers. This, is a problem; may be our biggest problem in Europe.

It perhaps underlies other knock-on effects, which is a lack of understanding of early stage capital requirements, what it really takes, to run and scale an internet business and being risk averse.

Read it and weep. I don’t agree with the crazy $1 billion invested in the likes of Groupon, but you can’t make butter with a toothpick. My own last start-up was expected to compete with our US counterparts of one fifth of the funding. The numbers seem pretty clear.

Read it and weep. I don’t agree with the crazy $1 billion invested in the likes of Groupon, but you can’t make butter with a toothpick. My own last start-up was expected to compete with our US counterparts of one fifth of the funding. The numbers seem pretty clear.

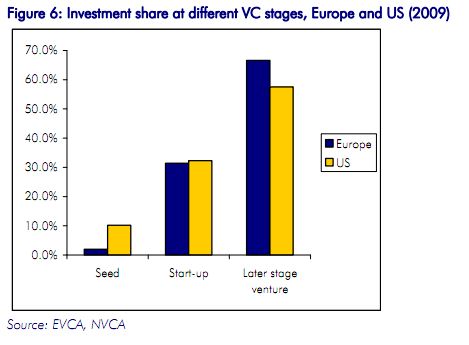

With little hands on experience, many European VC’s treat a start-up like an investment on the stock-market. Short termist, they undervalue Founders, don’t understand -or invest in- bold long term visions and they often under-capitalise (largely for all the reasons I’ve just listed). Facts seem to back this up (see graph above).

It is also claimed that European venture capitalists more commonly have a background in finance, while US venture capitalists tend to be scientists and ex-entrepreneurs. The implication is that the lack of scientific expertise among European VCs means they are less able to identify investments with high potential, than their counterparts in the US.

Bottazzi, Da Rin and Hellman (2004) undertook a survey of European VC and noted:

‘What may come as a surprise is that less than a third (of VC partners) actually has a science or engineering education.’

Half of all partners in their survey have some professional experience in the financial sector with ~40% having corporate sector experience. The recent European Investment Fund report by Roger Kelly, says that:

“Hege, Palomino and Schweinbacher (2009) observe that US VCs are often more specialized, and note that there is evidence that US venture capitalists are more sophisticated than their European counterparts, which contributes to the explanation for the difference in performance”

So Everything Is European VC’s Fault? Obviously not. I just personally feel it is the biggest single issue.

Entrepreneurs also have to up their game; pitches from many European founders are frankly terrible. Poorly delivered, unfocused product and ill-thought out business case. Both entrepreneur’s and employees need a more “can-do” attitude, to network better and think bigger. I’m not saying it’s easy, it’s not. I’ve been there many times and made many mistakes myself.

Some people say local culture doesn’t always help, that it’s not fashionable in many countries to be an entrepreneur or want to make millions. I’m not so sure this is an issue – doens’t seem to phase the stockbrokers.

The size issue probably doesn’t help; tax systems, incentives and finance rules are not consistent for VC across Europe – but then again the Finance industry has managed certainly in London (to disastrous results in 2008!) so why not tech VC?

European early stage VC is laughably low compared to the US, in European VC’s efforts to invest in later stage supposedly “safer” companies. All capital, little venture.

European early stage VC is laughably low compared to the US, in European VC’s efforts to invest in later stage supposedly “safer” companies. All capital, little venture.

What to be done?

As an ecosystem, as a government and as a Venture Capital community, we should then now focus more on how to scale our businesses and fund the existing innovation from the many good entrepreneurs, encouraging a drive for global domination and find a way to teach European venture capitalists how to be more entrepreneurial and visionary, rather than only get more people to start a tech-business, without the proper mid and late stage finance, skills and infrastructure in place.

* Seems to be a world or argument raging about dilemna or dilemma. OED says Dilemma, but then why does the Times write dilemna? I’m sure I was taught dilemna, but the odds seem to be on the side of dilemma.

More reading on European VC’s:

- http://techcrunch.com/2011/02/14/can-you-really-build-a-great-tech-firm-outside-silicon-valley/

- Some people believe European VC is doing just fine http://thenextweb.com/eu/2011/07/27/european-venture-capital-outperforming-the-us-report-claims/

- Source: http://urbanhorizon.wordpress.com/